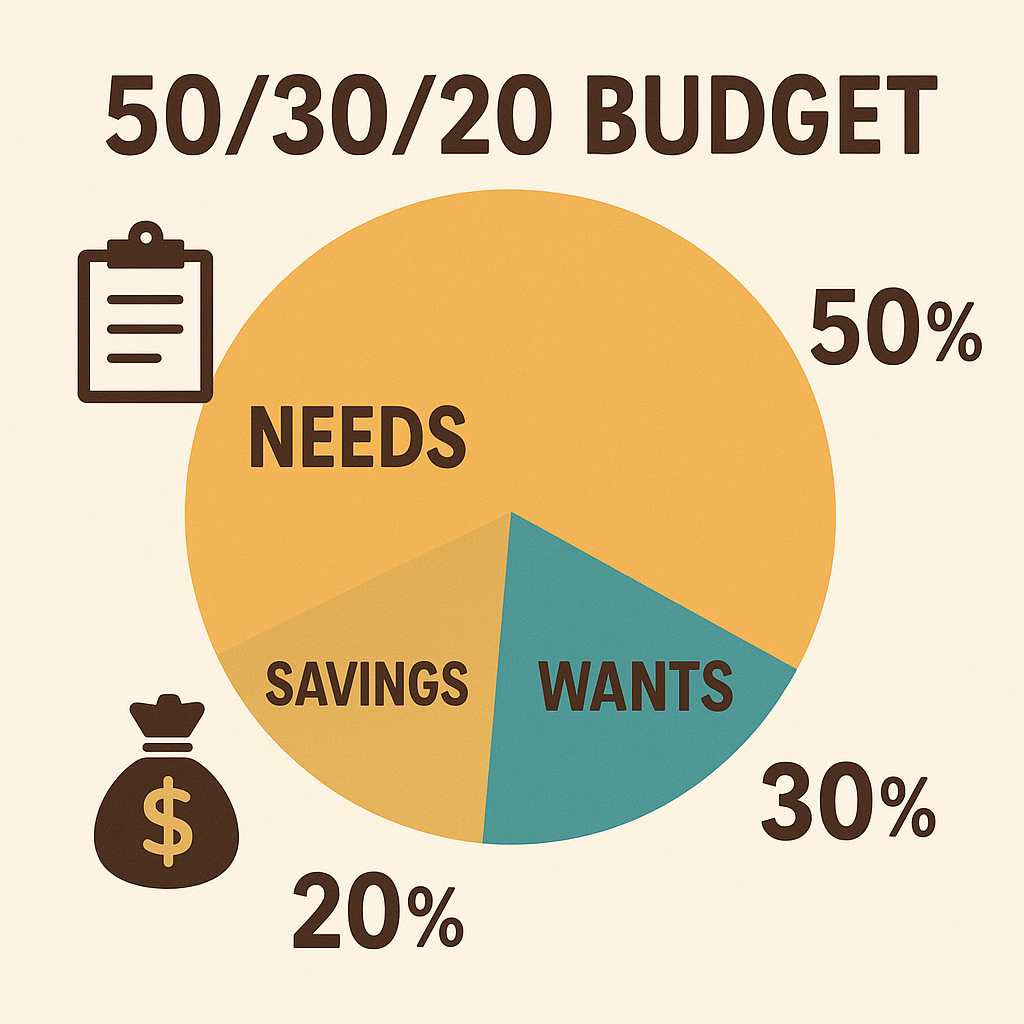

The 50/30/20 budget rule is one of the simplest and most beginner-friendly ways to manage your money. It gives you a clear structure that helps you control expenses, build savings, and stay organized—without complicated spreadsheets or strict tracking. Here’s exactly how it works and how to use it effectively.

1. What Is the 50/30/20 Budget Rule?

The 50/30/20 budget rule is popular because it’s easy to follow.

The 50/30/20 rule is a budgeting method that divides your monthly take-home income into three categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings or Debt Payoff

This structure helps you quickly see where your money should go, making budgeting simple even if you’ve never budgeted before.

2. What Counts as “Needs”? (50%)

Your needs are essential expenses—the bills you must pay to live and work.

Examples include:

- Rent or mortgage

- Utilities

- Groceries

- Transportation costs

- Insurance

- Minimum debt payments

- Medical essentials

If an expense is required for basic living or earning income, it belongs in this category.

3. What Counts as “Wants”? (30%)

Wants are non-essential things that improve your lifestyle but aren’t required.

Examples include:

- Eating out

- Shopping

- Entertainment

- Subscriptions

- Travel

- Hobbies

This category adds balance to your budget, allowing you to enjoy life while staying financially responsible.

4. What Counts as Savings or Debt Payoff? (20%)

This category strengthens your financial future.

Examples include:

- Emergency fund contributions

- Retirement savings

- Investments

- Extra loan payments

- High-interest credit card payoff

Treat this 20% bucket as your wealth-building section.

5. Example: Using the Rule With Real Numbers

Let’s say your monthly take-home income is $3,000.

Using the 50/30/20 breakdown:

- $1,500 (50%) → Needs

- $900 (30%) → Wants

- $600 (20%) → Savings/Debt

This gives you a simple roadmap for your money each month.

6. When the 50/30/20 Rule Works Best

This method is most effective for:

- Beginners who want a simple structure

- People with steady income

- Anyone overwhelmed by spreadsheets

- Those who want flexibility

It’s less strict than zero-based budgeting, making it easier to maintain long-term.

7. When You Might Need to Adjust the Rule

You may need to modify the percentages based on your situation.

Examples:

- High cost-of-living areas: Needs may be 60% or more

- Aggressive debt payoff: Savings/debt might increase to 25–30%

- Lower mandatory expenses: Wants might naturally fall below 30%

The goal is clarity and control—not perfection.

8. How the 50/30/20 Rule Improves Money Habits

Using this rule consistently helps you:

- Avoid overspending

- Stay organized

- Build meaningful savings

- Reduce financial stress

- Make better decisions with less effort

It’s simple enough for beginners and effective enough to use for years.

9. Pros and Cons of the 50/30/20 Rule

Like any budgeting system, the 50/30/20 rule has strengths and limitations.

Understanding these helps you decide whether it fits your financial situation.

Pros:

- Incredibly simple to maintain

- Gives you instant clarity on where your money should go

- Encourages a healthy balance between living and saving

- Works well for beginners who don’t want complicated tracking

- Helps reduce financial stress and decision fatigue

Cons:

- Not ideal for high cost-of-living areas

- Needs may exceed 50% for many people

- May feel too loose if you prefer strict tracking

- Doesn’t automatically account for irregular income

Even with these limitations, most beginners find the rule easy to follow and sustainable.

10. Tips for Making the 50/30/20 Rule Work for You

These simple adjustments make the rule more effective in real life:

- Automate payments so your Needs and Savings always come first

- Review your spending weekly to stay on track

- Use separate bank accounts — one for bills, one for spending

- Track Wants carefully (this is where most people overshoot)

- Increase savings to 25–30% when you get a raise

- Recalculate every few months as your income or expenses change

Small, consistent habits make this system powerful and long-lasting.

The 50/30/20 budget rule gives you structure, flexibility, and a simple blueprint for managing money without stress.

Related Guide

If you’re completely new to budgeting, you may want to read my guide on How to Start a Budget With Zero Experience to get the basics first.

External Resource

For more budgeting guidance, visit:

https://www.consumerfinance.gov